Multi-Family Construction Loans

LOAN AMOUNT

Min: $500,000

Max: $5,000,000

(Up to $10,000,000 on a case by case basis)

TERM LENGTH

12 to 24 Months

PROPERTY TYPES

5+ Unit Properties

Mixed-Use Properties

LOAN TYPES

Interest Only

MAX LOAN TO ARV

Up to 65%

FICO

Midscore 680

For Non-Recourse 700

RECOURSE

Full Recourse with Pledge of Equity of Borrowing Entity

Non-Recourse Options Available

MAX LTV

Up to 70% on Purchases

Up to 60% for Refi/Term

MAX LTC

Up to 85% w/ interest reserve, w/o interest reserve, 80%

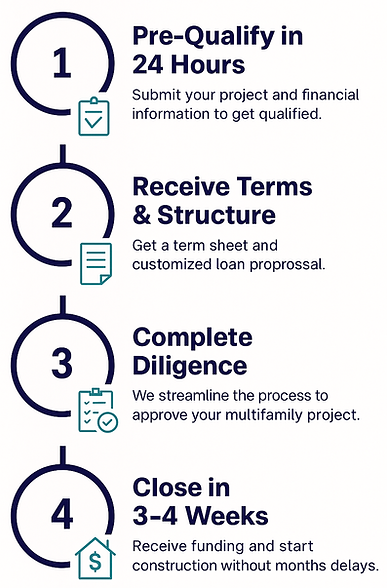

A Proven Process for Scalable Multi-Family Construction

At Trans‑Bay Capital, we understand the complexity of ground-up development. That’s why our loan process is built for clarity, efficiency, and developer control. From pre-qualification to milestone-based draws, our 4-step approach keeps your capital moving with your construction timeline.

Whether you're building a 10-unit rental or a mixed-use complex, we streamline funding so you can stay focused on execution.

Pre-qualify in 24 hours. Capital in 3–4 weeks.

Funding Multifamily Ground-Up Projects Nationwide

We work with developers across 44 states to finance new multifamily construction — from 10-unit infill deals to large-scale podium builds. If your project pencils, we’re ready to move.

“We needed a lender who could move fast and actually understand the construction side of the deal. Trans-Bay Capital delivered terms that worked, stayed involved through underwriting, and closed on time — without surprises.”

— Marcus Allen, Sequoia Urban Partners

$100M+ Deployed

50+ years experience

50+ Sponsors

.png)